Patient Financing

Salameh LippyLipo offers many financing options to make your dream a reality.

Our patient financing solutions empower you to pursue the procedure that resonates with you. We’re here to support you every step of the way, ensuring that you can focus on your transformation while we take care of the other details.

With PatientFi and CareCredit platforms, your patient experience is easier and more approachable than ever. You can simply and securely apply for financing in minutes, all in partnership with a provider you can trust. See the details below:

PatientFi

Many factors with PatientFi can help improve the patient financing experience. Here are just a few:

- Ease of application. Focused on a few key areas — and without a lot of complex jargon — the application can typically be completed within minutes.

- No hard credit check. We utilize a soft credit inquiry, and the application will not impact your credit score.

- Affordable interest rates. Several plan options, including some with 0% APR financing, are available for individuals who qualify.

- Seamless integration. Salameh LippyLipo procedures are fully eligible for patient financing through PatientFi.

CareCredit

CareCredit is another patient financing option we accept. Below are a few of the benefits of CareCredit:

- Multi-Use. You can use your CareCredit financing at over 225,000 enrolled providers across the nation.

- Long-Term Financing. CareCredit can finance for 24, 36, 48, or 60 months with Reduced APR and Fixed Monthly Payments.

- Affordable interest rates. For shorter-term financing options of 6, 12, 18, or 24 months, no interest is charged on $200+ purchases when you pay the full amount by the end of the promotional period.

- Seamless integration. As with PatientFi, procedures are fully eligible for patient financing through CareCredit.

Your journey to your best self should be as achievable, transparent, and well-supported as possible every step of the way. From initial conversations to lasting results, we look forward to providing you with an outstanding experience. For more information about our available procedures and patient financing options or to schedule a consultation, we invite you to contact us anytime.

Our Team

Entrust your journey towards treating lipedema in the hands of our dedicated team of experts, proficient in personalized care with LippyLipo. Dr. Salameh, a leader in lipedema treatment, has built a reputation that is unparalleled.

What's In The Blog?

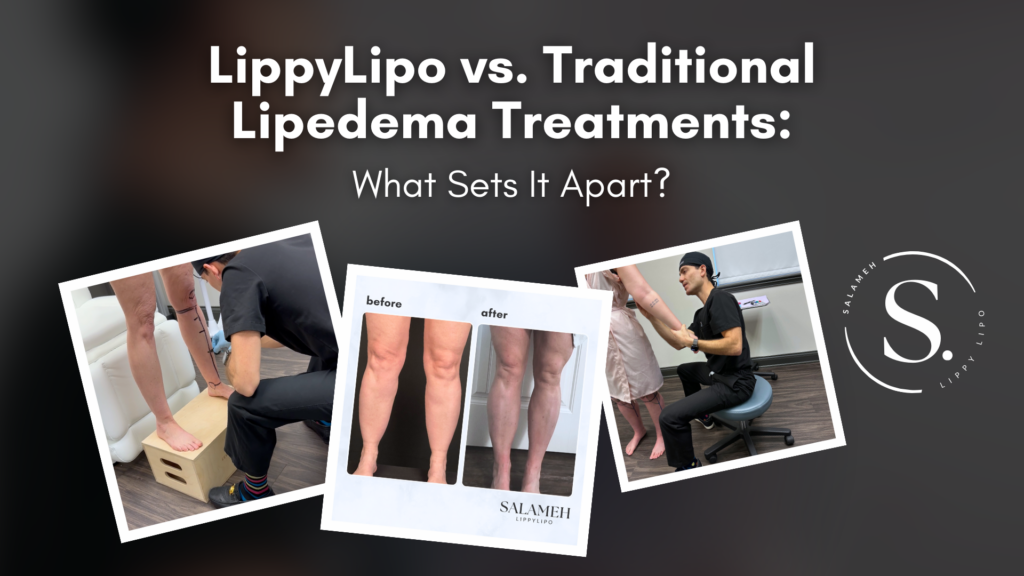

LippyLipo vs. Traditional Lipedema Treatments: What Sets It Apart?

What is Lipedema Fat? Lipedema is a chronic condition affecting millions, causing disproportionate fat accumulation in the legs, arms, and hips. Many patients struggle with pain, swelling, and mobility issues. While traditional lipedema treatments provide symptom relief, they often fail to target the root cause—the abnormal fat cells.LippyLipo, a cutting-edge awake liposuction technique developed by…